Your bank's routing number is important because it's the key to knowing where to send and receive money. (when companies ask for a voided check, it's usually to get this number)

If you want to find your routing number, the easiest way is to find one of your personal checks. There are a lot of numbers on a check.

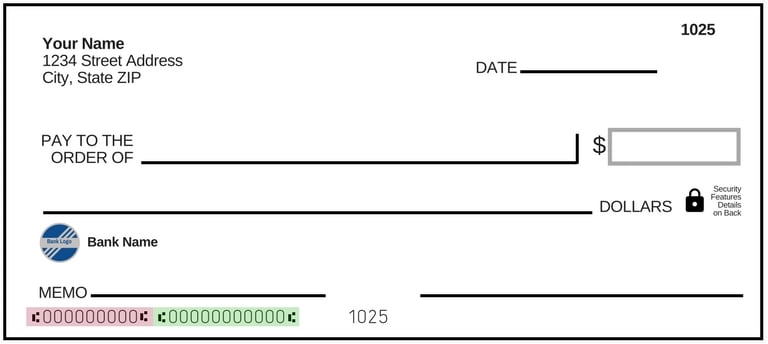

Let me steal this image of a check from our post on how to fill out a personal check:

See where it's highlighted pink and green? Those weird symbols (one long thing and what looks like a semicolon) at the bottom?

That's printed with magnetic ink and is part of MICR, or Magnetic Ink Character Recognition. The symbols tell a system to start reading.

The first pink 9-digit number is the ABA routing number. The next one, in green, will be your account number followed by the check number. Sometimes the account number and routing number are reversed, but it's in usually that order (if they are reversed, your account number won't be 9-digits).

That's the quickest way to find it.

The next easiest is to go to your bank's website look on the FAQ. You will need to know the state in which you opened your account, since many banks have many ABA numbers.

Take a look at the laundry list of ABA numbers for Chase, one of the largest banks in the world.

Here are the Citi® routing numbers, not nearly as long as Chase but still impressive:

| Citi® Location | Routing/Transit Number |

|---|---|

| Northern California | 321171184 |

| Southern California | 322271724 |

| Connecticut | 221172610 |

| Delaware | 021272655 |

| Florida | 266086554 |

| Illinois | 271070801 |

| Maryland | 052002166 |

| Massachusetts | 221172610 |

| Nevada – Las Vegas (Branches 27, 29, 30 & 56) | 122401710 |

| Nevada – except Las Vegas | 322271724 |

| New Jersey | 021272655 |

| New York | 021000089 |

| Pennsylvania | 021272655 |

| Texas | 113193532 |

| Virginia | 254070116 |

| Washington DC | 254070116 |

There's a reason why they have so many (and we'll get to that in a minute if you care) but the important part is that you need to find the ABA routing number for the state in which you opened the account. If you opened it in Florida, it'll be 267084131. If you then moved to California, your ABA routing number will not change.

Again, check your personal checks or call your local branch to make sure if you are uncertain.

Worst case scenario… you can always call and ask.

ABA Routing Numbers for Major Banks

We've compiled a list of all the ABA routing numbers for several major banks:

- Bank of America ABA routing numbers

- Chase Bank ABA routing numbers

- PNC Bank ABA routing numbers

- TD Bank ABA routing numbers

- Wells Fargo ABA routing numbers

How do Routing Numbers Work?

Each bank and credit union is issued a 9-digit routing number, also known as an American Bankers Association (ABA) number or a routing transit number (RTN).

This 9-digit ABA routing number makes it easy for the check processing system to identify the bank. They were created in the early 1900s when physical checks had to be sent back to the drawer's (the person writing the check) bank. Nowadays, after Check 21, everything is digital but the numbers remain.

The ABA routing numbers are still used to identify banks for other transfers, like Automated Clearing House (ACH) deposits and bill payments.

The American Banker's Association partners with Accuity to manage the Official Routing Number Registrar. They assign the routing numbers and manage the whole system – publishing a semi-annual American Bankers Association Key to Routing Numbers. This key lists all the assigned routing numbers.

Why Do Banks Have So Many Routing Numbers?

Some banks, especially the larger ones, seem to have more than one routing number. This happens when banks acquire or merge with other banks. Many of the larger banks have gotten that way through acquisitions, which explains why they have so many ABA routing numbers.

Technically, each bank is permitted up to five ABA RTNs. Some have more than five because with mergers you may have different entities holding different numbers. This happens a lot across state lines.

What is the Bank Routing Number format?

Of course, there's a format! (I don't know why but I love knowing this weird trivia stuff)

The 9-digits are organized as follows – XXXXYYYC:

- XXXX – Federal Reserve Routing Symbol – it refers to one of the 12 Federal Reserve Banks

- YYYY – ABA Institution Identifier

- C – Check Digit (used as a checksum on the whole number)

Did you ever notice a small fraction and numbers located on your personal checks? That's the ABA routing number too in another format, just in case the check gets damaged.

That's in this format – PP-YYYY/XXXX – except the PP isn't used anymore. It used to refer to the bank's check processing location by city.

XXXX – Federal Reserve Routing Symbol

The numbers are straightforward.

First two digits:

- 00 – United States Government

- 01 – Boston

- 02 – New York

- 03 – Philadelphia

- 04 – Cleveland

- 05 – Richmond

- 06 – Atlanta

- 07 – Chicago

- 08 – St. Louis

- 09 – Minneapolis

- 10 – Kansas City

- 11 – Dallas

- 12 – San Francisco

- 80 – Traveler's Checks

For “thrift institutions,” like credit unions, assigned a number before 1985, add 20. So Boston is 21. They no longer do this, thrift institutions get the same numbers as commercial banks.

For special purpose numbers used by non-bank payment processors, add 60.

The third digit is the Federal Reserve processing center for the bank.

The fourth digit is based on the state the Federal Reserve district is in. 0 if it's in the Federal Reserve city proper.

For example, Chase's ABA routing in California is 322271627. The Federal Reserve routing symbol is 3222 – which meant Chase likely acquired a thrift because 32 is San Francisco 912) plus 20. We know this to be a fact because Chase acquired the banking business of Washington Mutual in 2008 after WaMu collapsed and went into FDIC receivership.

Do You Checksum?

Now we're really getting into the weeds.

OK so the XXXX is the Federal Reserve number, the YYYY is for the bank – how do we calculate the checksum using C and thus verify that the number is properly formatted?

You do this calculation, where Dx is the xth digit:

3 ( D1 + D4 + D7 ) + 7 ( D2 + D5 + D8 ) + D3 + D6 + D9 mod 10 = 0

So for Chase in California's ABA of 322271627, we have:

3 ( 3 + 2 + 6 ) + 7 ( 2 + 7 + 2 ) + 2 + 1 + 7 mod 10 =

3 ( 11 ) + 7 ( 11 ) + 2 + 1 + 7 mod 10 =

33 + 77 + 2 + 1 + 7 mod 10 = 120 mod 10 = 0

Boom!

Fun right? 🙂

Now you know how to find your ABA routing number – go conquer the world!

My Money Wizard says

Nice tutorial, Jim. It seems simple enough, but I can remember how confused I was the first time someone asked me for my routing number.

Troy @ Bull Markets says

I always double check and triple check all the info whenever I send a wire transfer. A friend of mine made a mistake, and it took her a month to track down that money.