PNC Bank (FDIC #6384) is a National Bank with over 2,300 locations spread out across the nation.

If you look at PNC Bank’s history, the bank traces its origins back to 1852. In 1852, Pittsburgh National Bank, itself a subsidiary of Pittsburgh National Corporation, opened for business. Over the years, it would merge and acquire several other institutions, which is why PNC Bank has so many routing numbers.

inet

Each of those banks started with a routing number and, after acquisition or merger, those locations would keep their ABA routing numbers. So while the branches would say “PNC Bank,” the systems powering the transfers would use old numbers.

Sadly, PNC Bank’s website page for a routing number is not helpful.

If you’re looking for your PNC Bank routing number, here’s how to find it.

💵 U.S. Bank – up to $700

Earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. Subject to certain terms and limitations. Offer valid through June 27, 2024. Member FDIC.

Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

Table of Contents

Call Your Branch

PNC Bank is a tricky case because they acquired so many local banks, sometimes within the same markets, so you’ll have different routing numbers even within states. In Pennsylvania, where they started, there are six different routing numbers.

If you don’t have a checkbook handy, the quickest way is to contact your local branch and ask them. Otherwise, you run the risk of thinking you opened it in Central North when you opened it in Central South (or perhaps you were on the border). Your branch will know its correct routing number.

You can also call their national number – (888) 762-2265.

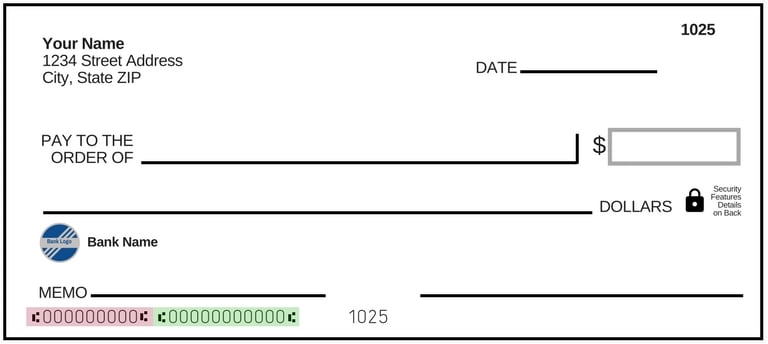

Look On Your Personal Checks

If you are near your checkbook, your personal checks contain a wealth of information including the ABA routing number for your branch.

The ABA routing number is always a 9-digit number, we highlighted it in red in the above image. The green number is your account number and usually much longer than 9-digits. If you aren’t sure if you have the right number, you can check this American Bankers Association Routing Number lookup tool and confirm it.

If you don’t have a check, you can always log into your PNC Virutal Wallet and look it up there.

PNC Bank Routing Number by State

If you don’t want to call or don’t have a check, you can try this table. Unlike a lot of other banks, PNC Bank sometimes has several ABA routing numbers within a state so this table isn’t going to be the best way unless you live in a state, like Illinois, where there is only one number.

Remember, your PNC Bank ABA routing number will be based on the state in which you opened your account, not where you live – if you see more than one number, or you don’t see your state listed, you will have to call your branch to find out which one it is:

| State | ABA Routing Number |

|---|---|

| Alabama | 062001209, 053100850, 043000096, 065103887, 065103625 |

| Delaware | 031100089 |

| Florida | 043002900, 267084199 |

| Georgia | 053100850, 061192630, 043002900, 061119639 |

| Illinois | 071921891 |

| Indiana | 083009060, 083000108, 071921891 |

| Kentucky | 083000108 |

| Maryland | 054000030 |

| Michigan | 041000124 |

| Missouri | 071921891 |

| New Jersey | 031207607 |

| New York | Call your branch |

| North Carolina | 043000096 |

| Ohio | 042000398, 041000124 |

| Ohio – Youngstown | 043000096 |

| Pennsylvania – Central North | 043000096 |

| Pennsylvania – Central South | 031312738 |

| Pennsylvania – Northeast | 031300012 |

| Pennsylvania – Northwest | 043300738 |

| Pennsylvania – Phildelphia | 031000053 |

| Pennsylvania – Pittsburgh | 043000096 |

| Virginia | 054000030 |

| Wisconsin | 071921891 |

| Washington D.C. | 054000030 |

Given how interspersed the routing numbers are, the safest bet is to call or check your personal checks.

Different Routing Number for Wire Transfers

Remember that these ABA routing numbers are only for ACH transfers. If you need to receive a wire transfer, you’ll want a different code.

- Domestic wire transfer (Wire Routing Transit Number) – 043000096

- International wire transfer (SWIFT/BIC Code) – PNCCUS33XXX

If you’re receiving a wire transfer, here’s the other information you may need to provide:

| Bank Name | PNC Bank, N.A. |

| Bank Address | Firstide Center, 500 First Avenue Pittsburgh, PA 15219 (regardless of where your account is located) |

| BNF/Field 4200 Beneficiary acct. # | Your complete PNC Bank account number |

| Beneficiary account name and address | The name and address of your account as it appears on your statement |

Double-check all your numbers if you’re going to send a wire transfer – they’re very difficult to reverse.