One of the first online bank accounts I ever opened was ING Direct.

ING Direct was the online bank of ING Group, founded a Dutch multinational corporation founded in 1991 (through mergers), and their high-interest rates were the talk of the financial world.

Back then, the only bank that offered high-interest rates were credit unions.

Credit unions were great (and still are) but not often known for their cutting-edge technology and online access. It’s understandable since they’re generally small, owned by the depositors, and you’d rather get a higher interest rate than a fancier website!

ING Direct offered all that. A higher interest rate and an online interface that could wow you. Everything was done online. You could open a certificate of deposit in minutes. You could add a new savings account, to save for a vacation or some other goal, in minutes. There were no branches but that meant you didn’t need to visit a branch to do anything. Everything was online and available in minutes.

Today, it’s known as Capital One 360 after Capital One acquired ING Direct for $9 billion back in mid-2011. It still has all the great features that ING Direct was famous for and today I’ll dig deeper into those to see if it might be the bank for you.

Table of Contents

About Capital One 360

Let’s get some paperwork out of the way. You know that I wouldn’t ever review a bank that wasn’t FDIC insured, that would be sheer insanity, but let’s make sure we have all that settle.

Capital One 360 is owned by Capital One Financial Corporation and headquartered in McLean, Virginia. When you do a search on the FDIC Bank Find tool, you’ll see several institutions named “Capital One.” This is because Capital One has brick and mortar locations for their bank, which is named Capital One Bank. The Capital One 360 entity is entirely separate.

So which one is Capital One 360?

Capital One, National Association (FDIC #4297) covers mostly deposits within branches. Capital One Bank (USA), National Association (FDIC #33954) covers mostly the deposits in the online bank.

Turns out, ING Bank (FDIC #35489) merged with Capital One Bank and on the BankFind page we learn that those accounts are covered under Capital One, NA (FDIC #4297)!

The FDIC # for Capital One 360 is, as far as I know, FDIC #4297. If you which to call them, the Capital One 360 phone number is 1-877-514-2265.

The ABA routing number is 031176110.

Capital One 360 Deposit Products

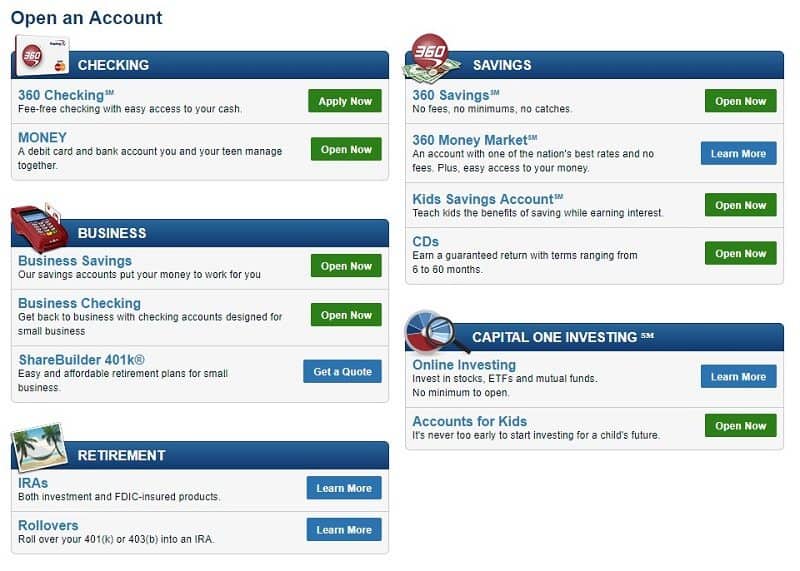

Capital One 360 has all the same deposit products as everyone else – online checking, online savings, certificates of deposit, etc.

No Fee 360 Checking – This is your standard online checking account. No minimum balance or minimum to open. The only knock is that the checking account’s interest rate is relatively low unless you deposit over $100,000. At the time of this writing, the APY is a mere 0.20% APY on balances under $50,000. You get a full 1% when it’s over $100,000 – a pretty high bar.

360 Performance Savings – Again, fairly standard stuff here – no minimum and no monthly fee. The interest rate here is more typical, currently 4.35% APY on any balance. One nice feature of Capital One 360 is that you can open up to 25 savings accounts. You can use them for different savings goals and it’s fairly simple to keep up. Each one will have their own account number so they’re truly individual accounts, so you can deposit money directly into them.

In October 2019, Capital One stopped offering the 360 Savings account and replaced it with the 360 Performance Savings account. It’s pretty much the same except a higher interest. If you had an existing 360 Savings account, you were not automatically moved over to the new account. You have to manually do that.

360 CDs – The CD rates at Capital One 360 are competitive with other online banks. You also have some options in maturity, 6 months all the way up to 60 months (5 years). No minimums. They’re way better than anything at a brick and mortar too.

Capital One 360 Fees & Penalties

Like many online banks, Capital One 360 has a very minimal fee structure. There are no balance requirements (and thus no monthly fees related to daily average balance or other typical brick and mortar bank shenanigans).

There is an extensive ATM network within the Capital One Bank system (2,000+ locations). You can use the Allpoint ATM network and 37,000+ of ATMs for free. If you use an ATM outside of the network, Capital One 360 will not charge you a fee but they will not reimburse you any fee charged by the ATM’s bank.

For overdrafts, there are two options for how to deal with it:

- Overdraft Line of Credit: There is also an overdraft line of credit product you can use to protect your checking account. The bank will let you overdraw your account and the overdraft will be a small loan on which you owe interest. You are notified when this happens and the APR will vary, but usually is in the double digits. They will do a soft pull on your credit when you set this up.

- Free Savings Transfer: This sounds exactly like what it does – when you overdraft your checking, they transfer money from your linked savings account. It has no cost but you need to be aware of the six transfer rule for savings accounts.

The early withdrawal penalty fee on their CDs is also typical – “You can always decide to withdraw your money early. However, like with any CD account, there is a penalty for withdrawal prior to the end of your CD term. For 12 month CD accounts (or less), the penalty for withdrawing early is 3 months of interest. For CD accounts longer than 12 months, the penalty for withdrawing early is 6 months of interest.”

Referral Program

One of the nice little perks of these accounts is a holdover from the ING Direct days. You can refer your friends to become new accountholders and you both get a little extra cash.

Find a friend with an account and ask for a referral, which they can find in their account once they log in. Look at the bottom for a little box that looks like what you see to the right.

They can open a 360 Savings, 360 Money Market, or a 360 Checking account to earn the referral money.

For the savings and checking, they open and deposit at least $250. For the checking, they need to make 3+ debit card purchases or Person2Person Payments (or a combo of the two) within 45 days. Then they get $25.

Capital One no longer offers a money market account.

You get $20 for your trouble each time, up to 50 times ($1000).

New Account Bonus

If you have a little more cash to deposit, you should check out Capital One 360’s new account bonus. You can get $250 when open a Capital One 360 Checking account with the promo code REWARD250 and you receive 2 direct deposits each of $500 or more within 75 days of account opening.

It’s a pretty easy bonus to get if you have a direct deposit to move so you’ll want to take advantage if you qualify.

Pros and Cons

The biggest pro is that you can open up to 25 savings accounts. This can make account management super simple if you like using your bank accounts for savings goals. With no minimum and no fees, you don’t have to worry that your organizational needs will come at some kind of cost. The interest rate on the savings account is competitive at any balance level too, so you don’t need to combine them to get the best interest rate.

I like to use a Capital One 360 savings account as a bank account firewall, protecting my “real” accounts from potentially breachable accounts (like PayPal).

The biggest con is that the checking account interest rate is low if you have under $50,000 saved in that account. It’s not a huge con but it still is a little strange that they’d set it up this way.

Conclusion

I like Capital One 360 and I still have my account there. It checks all the boxes you want in an online bank but if you’re looking for a new one, I think there are better options out there.

If you already have an account there and want to know if you should move, you can find slightly better options but they’re not so much better that it’s worth making the change.

Greg says

Check out Ally back (ally.com). 1.45% on savings accounts at this moment.

Ally is awesome! They’re my main bank now, I still keep my Capital One 360 for a firewall but everything else banking is Ally.

List of the tools & accounts I’m using now – https://wallethacks.com/resources-tools/

Erin says

Hi! How do you make cash deposits?

I’m afraid you can’t make cash deposits into an online bank account.

DNN says

With some credit card companies, cardholders have to be mindful to keep a close eye on their credit card balances after they pay off the balance in full. Some credit card companies will try to sneak in interest fees long after you pay your card balance off. When things like that happen, it can lead to false late fees and potentially ridiculous finance charges. Be mindful to setup a credit card bill alert on your smartphone or PC for when any kind of charge hits your credit card account so you can dispute it right away.

John Harper says

I’ve been with Capone bank for almost 10 years. Saw that they had a signup bonus and a halfway decent interest rate for the 360 Money Market. Even though I was transferring from another account from Cap one they said I would get the bonus and it would take 3 months to post. Was a decent chunk of $. Guess what, didn’t post. Called and issued a complaint. Long story short, 6 months later, even though they admit that the rep said I’d get the bonus they refuse to give it to me. Never again. Don’t deal with a company that tells you one thing then does another and doesn’t care about a long time customer. Avoid.